Understanding your homeowner’s insurance policy can be tricky, but knowing what’s covered is crucial for peace of mind. One important section is Coverage C, which deals with your personal property. So, what exactly does Coverage C of a homeowner’s policy cover? Here’s a breakdown:

- Personal Belongings: This is the core of Coverage C. It covers most of your personal property, including furniture, clothing, electronics, appliances, and jewelry. This applies whether these items are inside your home or temporarily located elsewhere (e.g., in a storage unit).

- Replacement Cost vs. Actual Cash Value: Policies usually offer coverage in one of two ways: Replacement Cost (RCV) or Actual Cash Value (ACV). RCV pays the cost to replace the item with a new one, while ACV pays the current market value, taking depreciation into account. RCV is generally preferable, though it may come with a higher premium. Check your policy to see which coverage type you have.

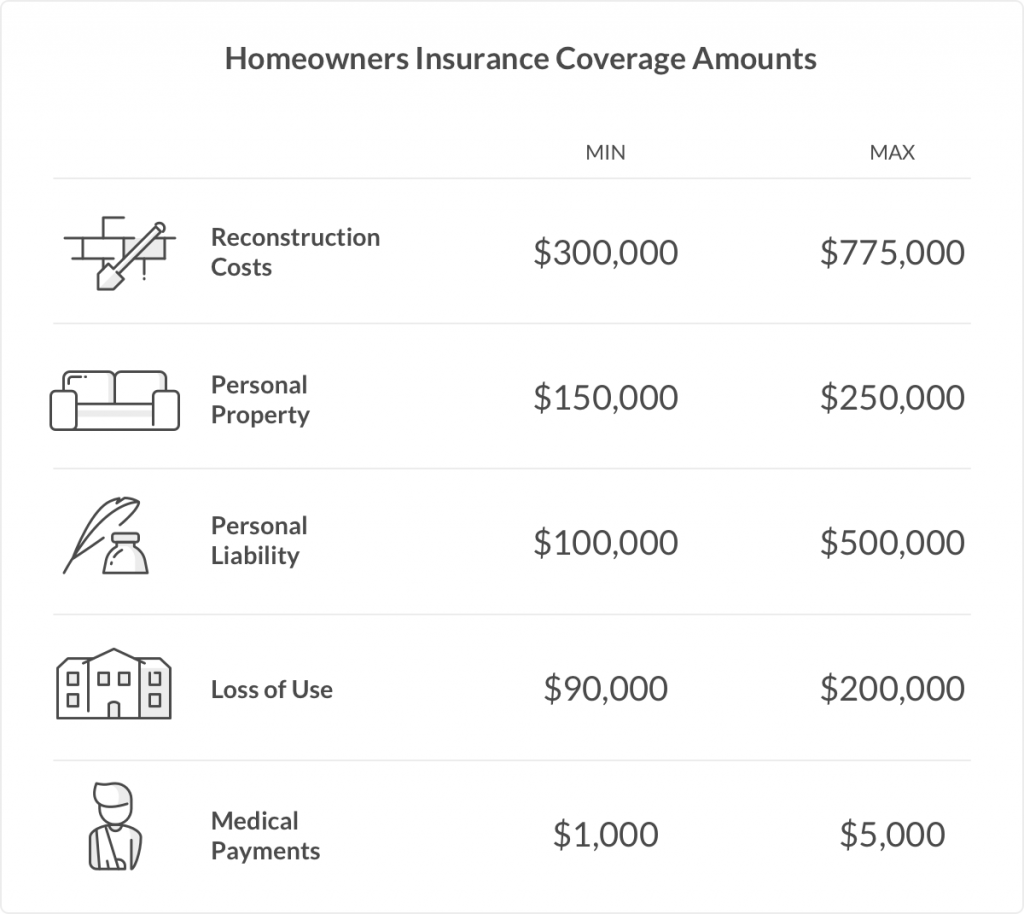

- Coverage Limits: Your policy specifies a limit for Coverage C, representing the maximum amount the insurance company will pay out for covered losses to your personal property. Ensure this limit is sufficient to replace your belongings if they were all destroyed. Consider a personal property inventory to estimate the value of your items.

- Named Perils vs. All-Risk/Open Peril: Some policies are “named peril,” meaning they only cover losses caused by specific perils listed in the policy (e.g., fire, theft, windstorm). “All-risk” or “open peril” policies cover any peril except those specifically excluded in the policy. All-risk provides broader coverage.

- Specific Exclusions: Coverage C typically excludes certain items or perils. Common exclusions include:

- Damage from pests or vermin

- Wear and tear

- Damage caused by inherent defects

- Certain types of valuable items may have sub-limits (e.g., jewelry, furs, firearms). You may need to schedule these items separately for full coverage.

- Off-Premises Coverage: Coverage C often extends to personal property even when it’s not on your property. For example, if your laptop is stolen from your car while you’re traveling, it might be covered.

It’s always best to review your specific homeowner’s insurance policy and speak with your insurance agent to fully understand your coverage and any limitations that may apply.

If you are searching about Optional Coverage You’ll Want to Add to Your Home Insurance Policy you’ve came to the right web. We have 35 Pictures about Optional Coverage You’ll Want to Add to Your Home Insurance Policy like Coverage | PDF, Home Coverage by Josh Warren on Dribbble and also 7. Reactis Coverage Metrics — Reactis for C User's Guide V2024. Read more:

Optional Coverage You’ll Want To Add To Your Home Insurance Policy

Optional Coverage You’ll Want to Add to Your Home Insurance Policy

Concept Of Home Coverage Stock Photo. Image Of Safe – 145289144

Concept of home coverage stock photo. Image of safe – 145289144

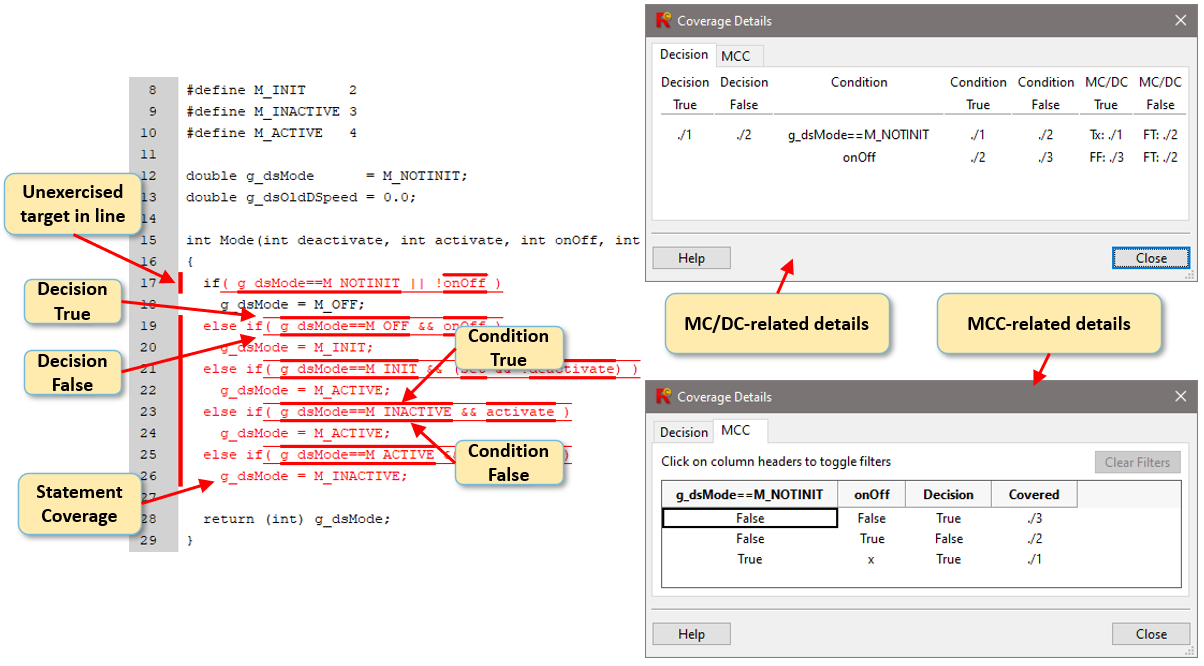

7. Reactis Coverage Metrics — Reactis For C User's Guide V2024

7. Reactis Coverage Metrics — Reactis for C User's Guide V2024

Home Coverage Options – Thank Goodness For Insurance

Home Coverage Options – Thank Goodness For Insurance

C): Maximum Coverage Case | Download Scientific Diagram

c): Maximum Coverage Case | Download Scientific Diagram

What Is Dwelling Coverage? | Insuropedia By Lemonade

What is dwelling coverage? | Insuropedia by Lemonade

Solved The Coverage Of A Home Insurance Policy Would Cover | Chegg.com

Solved The coverage of a home insurance policy would cover | Chegg.com

High-Value Home Insurance Providers | Openly

High-Value Home Insurance Providers | Openly

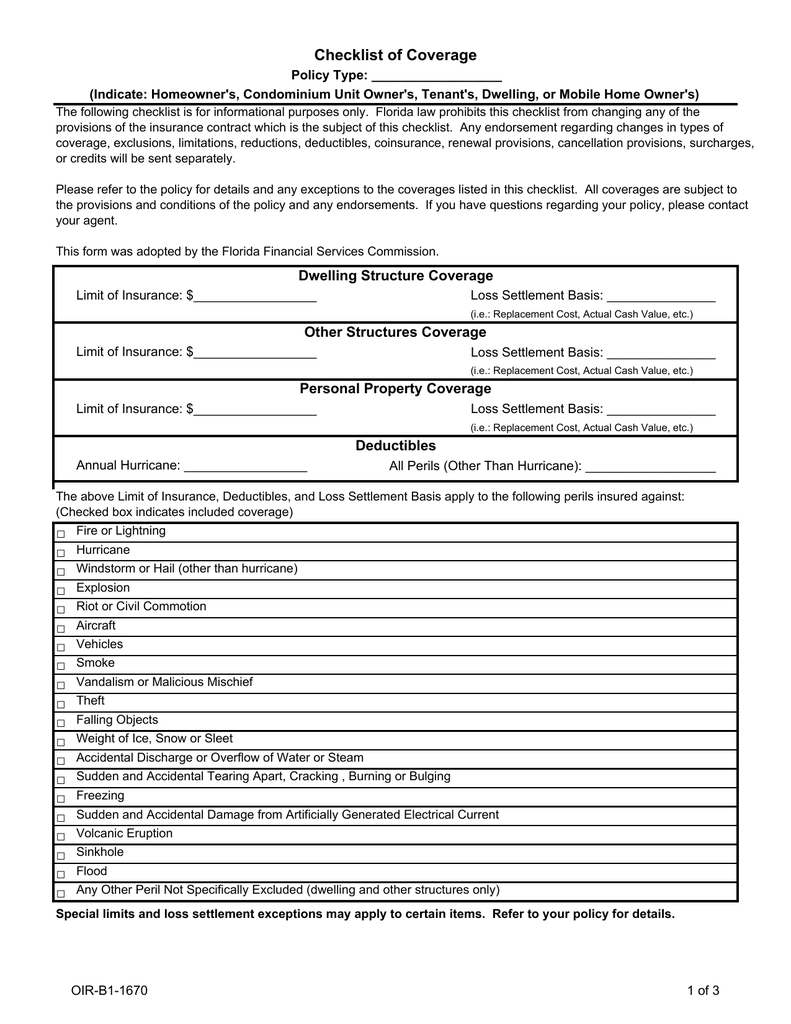

Checklist Of Coverage

Checklist of Coverage

Coverage | PDF

Coverage | PDF

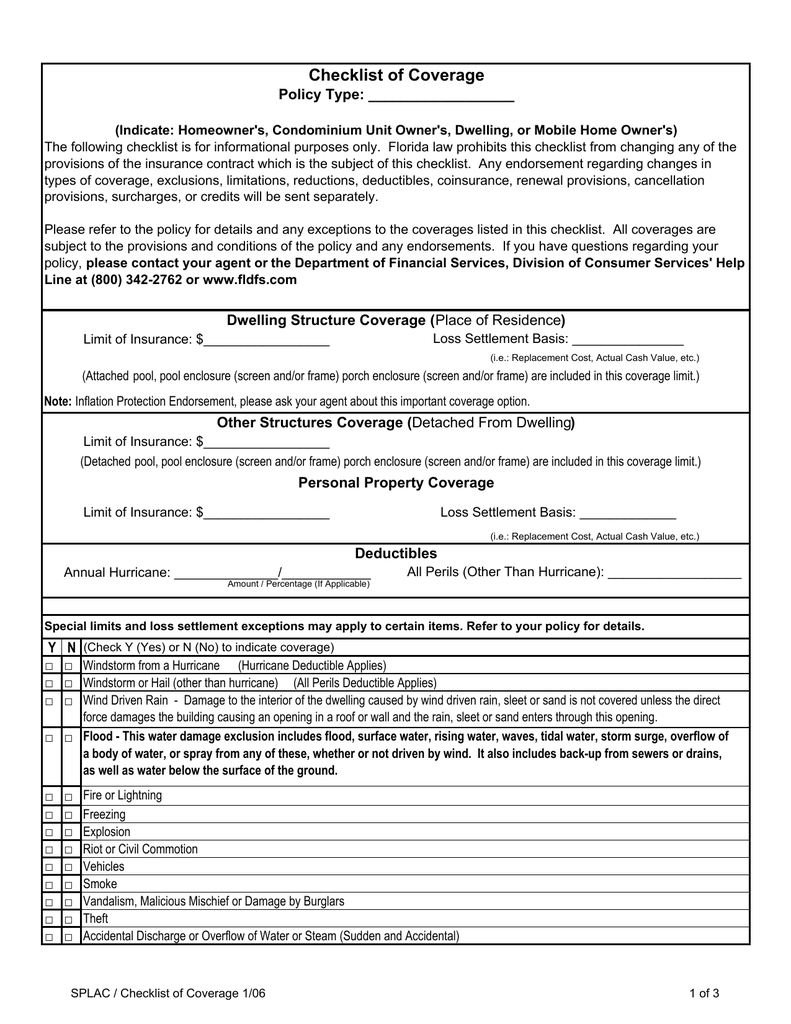

Checklist Of Coverage Policy Type:

Checklist of Coverage Policy Type:

C# Code Coverage To Near 100%? – Timdows

C# code coverage to near 100%? – timdows

What Is Coverage C Personal Property?

What is Coverage C Personal Property?

Code Coverage Settings

Code Coverage Settings

COVERAGE ESSENTIALS: Homeowners Part 1 – Policy Definitions, Liability

COVERAGE ESSENTIALS: Homeowners Part 1 – Policy Definitions, Liability …

What Are The Three Most Common Homeowner Policy Coverage Areas?

What are the three most common homeowner policy coverage areas?

Coverage A – Dwelling – Orion180

Coverage A – Dwelling – Orion180

10 Essential Coverage Items To Consider In Your Home Insurance Policy

10 Essential Coverage Items to Consider in Your Home Insurance Policy …

Concept Of Home Coverage, Geometric Pattern Stock Illustration

Concept of Home Coverage, Geometric Pattern Stock Illustration …

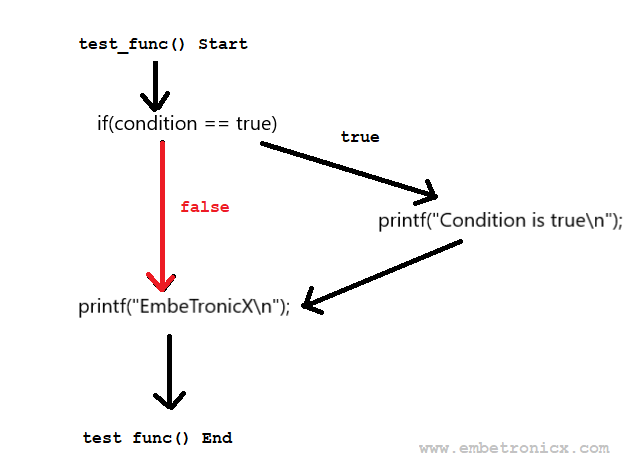

Unit Testing In C – Code Coverage Tutorial ⋆ EmbeTronicX

Unit Testing in C – Code Coverage Tutorial ⋆ EmbeTronicX

Home Warranty Coverage Optional Add-On Plan — American Home Protect

Home Warranty Coverage Optional Add-On Plan — American Home Protect

Managing Code Coverage Suites | AppCode Documentation

Managing code coverage suites | AppCode Documentation

Home Insurance Breakdown: What Is Coverage C (Personal Property)?

Home Insurance Breakdown: What Is Coverage C (Personal Property)?

What Is Coverage B (Other Structures)? | Universal Property

What Is Coverage B (Other Structures)? | Universal Property

Decoding The Basics Of Home Insurance Coverage – Good Decisions

Decoding the Basics of Home Insurance Coverage – Good Decisions

Home Insurance Coverage: A Detailed Guide – AloneReaders.com

Home Insurance Coverage: A Detailed Guide – AloneReaders.com

The Right Coverage For Your Home – SurNet

The Right Coverage for Your Home – SurNet

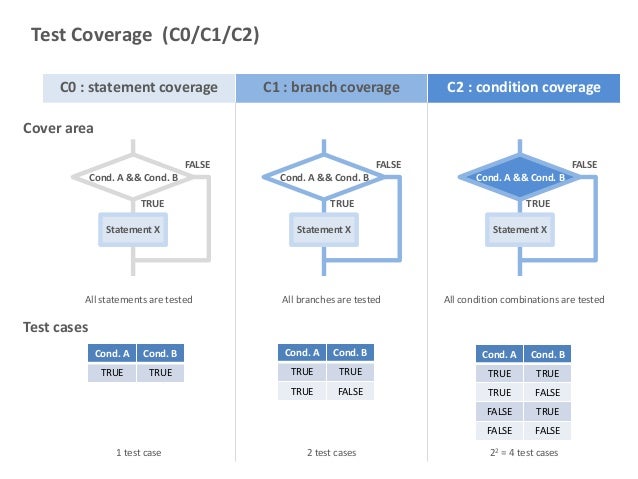

Test Coverage

Test Coverage

Citizens Homeowner Policy Coverage Gaps – Lee County Insurance

Citizens Homeowner Policy Coverage Gaps – Lee County Insurance

Types Of Homeowners Insurance Coverage Policy

Types Of Homeowners Insurance Coverage Policy

What Is Coverage C In Homeowners Insurance? (Explained)

What Is Coverage C In Homeowners Insurance? (Explained)

Home Coverage By Josh Warren On Dribbble

Home Coverage by Josh Warren on Dribbble

Seven Reasons To Get Insurance Coverage For Your Home – Livinator

Seven Reasons to Get Insurance Coverage for Your Home – Livinator

What Do The Types Of Coverage Mean In Your Homeowners Policy

What Do the Types of Coverage Mean in Your Homeowners Policy …

What Are Coverage Types? Leia Aqui: What Are The 4 Types Of Coverage

What are coverage types? Leia aqui: What are the 4 types of coverage …

Coverage essentials: homeowners part 1 – policy definitions, liability. What do the types of coverage mean in your homeowners policy …. What are the three most common homeowner policy coverage areas?

The visuals provided are strictly for demonstration use only. We never host any external media on our servers. All content is embedded directly from public domain sources used for informative use only. Assets are provided straight from the original providers. For any legal complaints or requests for removal, please reach out to our support team via our Contact page.